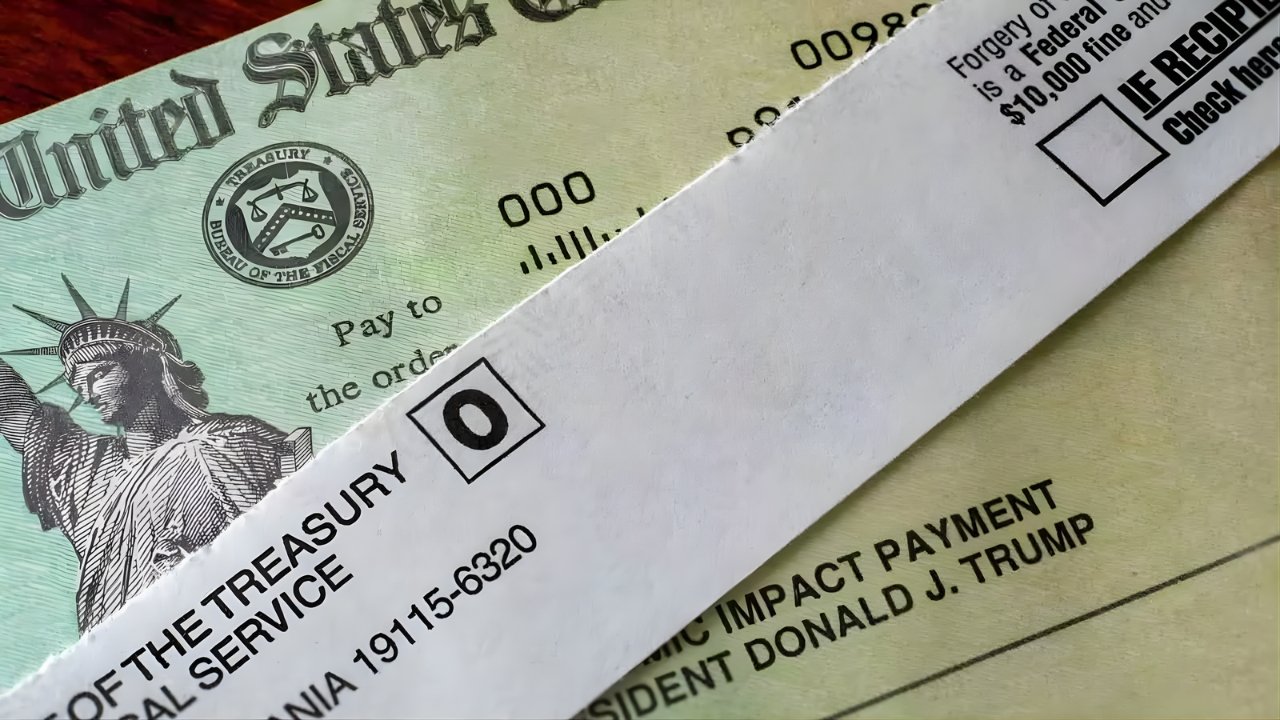

Discussion about a stimulus in form of 1000 dollars to seniors in the year 2025 is already trending online and in social media circles. There is also great optimism of the additional financial aid in the form of inflation although there is a need to differentiate between national federal requirement and particular state-wide governments that are literally providing money. By the end of 2025, there exists no federal law that would ensure that every elderly American receives a $1,000 stimulus check, but citizens of certain states such as Alaska and Pennsylvania are actually receiving checks of the amount in their wallets or can pick them up.

The Federal Stimulus Myth

The most widespread rumor about the IRS is a fake one that it is issuing a bonus cash of $1,000 to all Social Security users. This misinformation can mostly be based on the reporting on tax credits or proposals that never materialized into law. A fourth round of Economic Impact Payments is authorized by no federal law and the Social Security Administration has confirmed that the only countrywide increase in 2026 will be the regular Cost-of-Living Adjustment that will increase monthly payments by an average of 2.8 percent instead of the lump sum.

Alaska’s Confirmed $1,000 Payment

In the case of the seniors residing in Alaska, the payment of the 1000 is actual and already has a definite roadmap. The Permanent Fund Dividend (PFD) program in the state paid a dividend of about $1,000 to the qualified residents on December 18, 2025. This is a share of oil revenue distributed by the state to residents who have lived in Alaska all that year and have no plans of leaving; those individuals who had their applications noted as qualified but not paid out by the first month of December should have received this particular payment only days ago.

Pennsylvania Property Tax and Rent Rebate

The program is legitimate and available in Pennsylvania, which provides up to 1000 dollars in relief to the seniors, and is frequently confused with a federal stimulus check. The Property Tax/ Rent Rebate Program has been broadened to raise the income eligibility boundaries so that more seniors can receive between 380 and 1000 in payments. This does not happen automatically, the seniors who have attained the age of 65 and above, widows and widowers who have attained the age of 50 and above, and individuals with disabilities who have attained the age of 18 and above need to file an application to demonstrate that they paid property taxes or rent in the past year to be able to receive this rebate.

Tax Rebate Relief in New Mexico

The other source of the amount of 1,000 is that of New Mexico, where tax rebates have been a regularly recurring type of a form of financial support. The state has already come up with rebate in which married couples that were filing jointly could obtain rebates up to 1,000 according to the status of their tax returns. These checks are based on the state budget surpluses and the approval of the legislature every year, but are one of the few examples where the government check is the same as the rumor on the virus is, but has to file a state tax return to collect the check.

Other State Surplus Refunds

There are also other states that are using the budget surpluses to refund money to taxpayers, which is usually collected in false national headlines. States such as Minnesota, Massachusetts and Georgia have rolled out a number of different refund schemes over the previous year but with varying amounts, and hardly any are simply a blanket refund of $1,000 or less. Elderly persons should visit their respective Department of Revenue websites to determine whether a refund in excess is to be obtained because they are nearly always connected with tax filings and not with enrolment in Social Security.

Avoiding Stimulus Scams

The misunderstanding about these state specific payments provides an excellent opportunity to scammers that attack older adults. You must be much suspicious of any phone call, e-mail or text message that states that you have a pending deposit of $1,000 that needs completion by payment of a processing fee or verification of your Social Security number to release. There will never be any case when a legitimate government agency such as the IRS or state revenue departments uses unofficial methods to make any demand on immediate payment or personal information to unlock a benefit.

Snapshot: $1,000 Payments by Location

| Program | Location | Amount | Status |

| Federal Stimulus | Nationwide | $0 | Fake / Rumor |

| Permanent Fund Dividend | Alaska | ~$1,000 | Paid Dec 18, 2025 |

| Property Tax/Rent Rebate | Pennsylvania | Up to $1,000 | Application Required |

| Tax Rebates | New Mexico | Up to $1,000 | Dependent on Filing |

| COLA Increase | Nationwide | ~2.8% Increase | Monthly (Not Lump Sum) |

FAQs

Q: Does the 1,000 stimulus package apply to all the seniors in the US?

A: No. No national 1000 stimulus check. State-level payments of this amount may only be offered to seniors depending on the state in a country such as Alaska or Pennsylvania.

Q: when was Alaska payment of $1000 sent?

A: The last delivery to eligible Alaska residents will be December 18, 2025. In case you have not yet obtained it and are eligible, check your application status (PD) online.

Q: Will I need to claim the Pennsylvania rebate?

A: Yes. Pennsylvania Property Tax/Rent Rebate is not automatic. To be able to receive the funds, you have to apply with showing the evidence of the income and property taxes or rent payments.

Disclaimer

This article is not an informational paper but a mere financial or legal advice. Government welfare schemes, qualification regulations and payments are liable to alteration. You should always check the details about financial payments on official sites like IRS.gov or on the Department of Revenue of your state itself.